Payroll Tax

Payroll tax is a self-assessed tax on the wages that employers pay to their Queensland employees when the total taxable wages are more than a certain threshold. It is a levy on taxable wages paid within a particular state or territory by employers. The payroll tax base included wages, salaries, superannuation and other forms of employee benefits such as bonuses and fringe benefits.

The payroll tax rates and thresholds vary between state and territories and is administered by revenue offices in each individual state and territory. Over recent years there has been progress towards a harmonised approach between the states in several key areas. In Queensland, payroll tax is administered by the Queensland Revenue Office and returns are lodged via QRO online. For further information on QRO online: https://qroonline.treasury.qld.gov.au/

An employer must register for payroll tax within 7 days after the end of the month in which they:-

- Pay > than $25,000 a week in Australian taxable wages, or

- Become a member of a group that together pays > than $25,000 a week in Australian taxable wages.

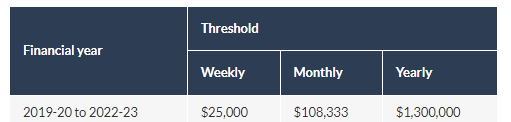

Businesses may be grouped and treated as one unit for payroll tax if they are related or connected. The current threshold is $1.3 million in Australian taxable wages annually or $108,333 monthly. If your annual taxable wages are $1.3m or less, you may not have to pay payroll tax, but you still might need to register for payroll tax and lodge annual returns.

If you are a member of a group of employers, the $1.3m threshold is calculated on the group members combined annual Australian taxable wages.

If you do not employ for a full financial year, the $1.3m threshold is calculated proportionately on the number of days you paid, or liable to pay.

The table below details the weekly, monthly, and yearly thresholds that apply.

In QLD the payroll tax % rate is:

- 4.75% for employers or groups of employers who pay < $6.5m or less in Australian taxable wages

- 4.95% for employers or groups of employers who pay > $6.5m or more in Australian taxable wages

Regional employers are entitled to a 1% discount on the rate until 30 June 2023.

Fixed Periodic Deductions

A deduction can be claimed if you:

- Are not in a group but pay interstate wages, or

- You are a designated group employer.

The periodic deduction is calculated using the estimated Queensland and interstate taxable wages for the full financial year, for non-grouped employers and estimated total groups Queensland and interstate taxable wages for the full financial year, for designated group employers.

A fixed periodic deduction calculation or the estimator is available in QRO Online to work out what the deduction will be.

Components of Payroll Tax

Include the following taxable wages in completing returns:

- Gross salary and wages for payroll tax

- Termination Payments (Except payments that are not taxed such a redundancy payments)

- Bonuses

- Taxable allowances

- Interstate Wages

- Groups of businesses

- Contractor payments

- Commissions

- Director fees

- Shares and options

- Superannuation contributions

- Salary sacrifice arrangements

- Fringe benefits

- Termination payments

Exempt wages for Payroll Tax

The following wages are exempt from payroll tax in Queensland:

- Apprentices and trainees

- Employers with special exemptions

- JobKeeper payments

Apprentices and Trainees are exempt from payroll tax if the employee has signed a registered training contract with their employer to undertake an apprenticeship or traineeship under the Further Education and Training Act 2014. There are several restrictions surrounding these areas in terms of exempt wages.

Some employers have special exemptions from payroll tax. These include public hospitals, charitable institutions, teachers training college, local government, consular and other government bodies.

Mental Health Levy

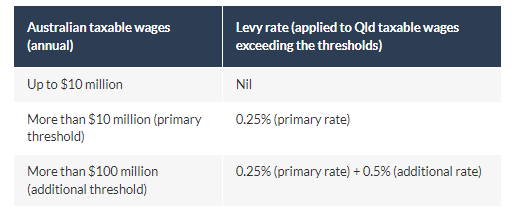

From 1 January 2023, a mental health levy will apply to employers and groups of employers who pay more than $10m in annual Australian taxable wages.

This levy applies to:

- Employers and groups of employers who pay > than $10m in annual Australian taxable wages

- Annual Queensland taxable wages

Payroll Tax Due Dates in Queensland