Not eligible for JobKeeper 2.0? You may be eligible for eased employment restrictions

Legacy Employers

With the extension of JobKeeper has also come about a new term, Legacy Employers. These employers can use some of the employment provisions provided under JobKeeper for their previously eligible employees if certain conditions are met.

What is a Legacy Employer?

A Legacy Employer is an employer who previously participated in the JobKeeper scheme but either chooses not to continue with the scheme or are no longer eligible past 27 September 2020, as they do not meet the minimum 30% decline in turnover. They must however be able to demonstrate at least a 10% decline in turnover for the relevant quarter.

What Can a Legacy Employer Do?

Under the extended JobKeeper provisions, legacy employers can:

- issue JobKeeper enabling stand down directions (however this cannot result in the employee working less than 60% of their previously agreed ordinary hours of work & not less than 2 hours on a working day)

- issue JobKeeper enabling directions in relation to employees’ duties and locations of work

- make agreements with employees to work on different days or at different times (with some changes).

Some of the important changes to note from the original JobKeeper provisions are that you must comply with these additional consultation requirements:

- A minimum of 7 days written notice must now be provided (previously this was 3) but additionally there are consultation requirements including;

- providing the employee (or the employee’s representative) with specific information about the nature, timing and expected effects of the direction;

- inviting views and feedback about the proposed direction from the employee (or the employee’s representative);

- genuinely considering the employee (or employee’s representative) views and feedback; and

- keeping a written record of the consultation.

Meeting the 10% Decline In Turnover Test Each Quarter

To demonstrate this decline, employers must obtain a certificate from a relevant financial service provider, such as your accountant, or if you a small business employer, make a statutory declaration.

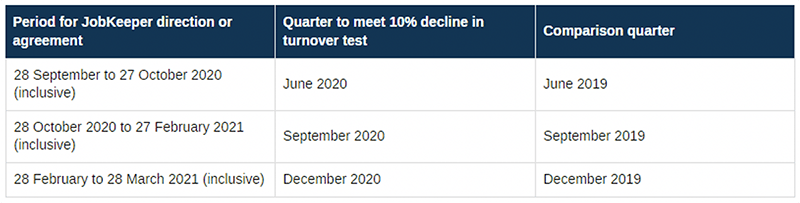

In order to make an agreement or give a JobKeeper direction to your staff when the extended provisions apply, the certificate or statutory declaration needs to be held for the corresponding quarter as per below:

Record Keeping

Certificates are issued by eligible financial service providers for the purpose of qualifying for the extended JobKeeper provisions as a legacy employer. These records should be kept as evidence of the decline in turnover.

This provision gives employers flexibility, but you still miss out on what JobKeeper provided you – security in keeping your good staff! It is important to know where you stand so you do not cause yourself unnecessary Fairwork issues. Please contact us at Evolve Online Bookkeeping on 07 5413 9393 if you need help with your bookkeeping and payroll.

- The Evolve Online Bookkeeping team